List of the Things You Can Use Reddit For in 2022

The future of advertising on Reddit is bright. There are several ways to get your brand’s name on the front page. You can also use calendar ads to remind people of upcoming events. They can build anticipation for your product or service. In 2022, you should be able to see more of these types of ads on the front page. We have listed for you five ways to use Reddit for advertising.

Getting a spot on Reddit’s front page

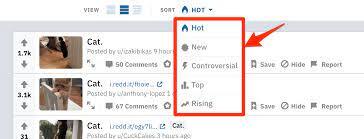

You’re not alone if you want to be part of the Reddit front page in 2022. Reddit, besides being a social news site, is also an entertainment website where users submit content, often in the form of a text or link. This content is then ranked by other users, who can vote it up or down, determining where it appears on the front page and other pages.

The r/place subreddit became a hub of activity for four days last year, with fans coordinating on social networks to create a virtual canvas. The event lasted four days, with users completing one pixel of color every five minutes. It was a unique way to participate in Reddit, and participants included some of the biggest names in content creation.

Monitoring Reddit for brand mentions

There are a few reasons why brands should monitor Reddit for brand mentions. People use Reddit to discuss products, ask questions, and air complaints. Brands should consider implementing a community management plan to engage with their target audiences and increase sales. The community of Reddit is not about spam but rather authenticity and transparency. One hat brand that used Reddit to promote its business made over $28,000 after a single mention.

Many niche subreddits on Reddit, including fashion, technology, and lifestyle. Moreover, users on the platform continuously use the site for market research. Monitoring Reddit for brand mentions is important to stay ahead of your competitors. For example, a hat brand can use a tool to track the words of a particular hat brand across 138,000 active communities.

Monitoring Reddit for customer service

As the world’s largest social community, Reddit is a vital tool for businesses to monitor. This community is not to be ignored, with millions of monthly active users. You can gain over a hundred thousand potential conversions if you properly monitor Reddit. However, brands should be aware of some red flags when watching Reddit. Below are some tips for customer service teams who want to succeed in this community.

Creating a community on Reddit

Creating a community on Reddit requires some effort. For starters, you must decide which topic you would like to post about and what kind of community you want to create. Once you’ve chosen a case, you can create a subreddit around that. Next, you’ll need to fill out a form with a few simple boxes. In recent years, this process has been made easier.

The community is an essential aspect of a business’s success on Reddit. Users are frank and candid, so your business needs to be authentic and open to your brand. If you answer questions from potential customers, you’ll set yourself up as an expert and build trust. And if your business offers an online community, you’ll be able to help future customers find answers to their questions.

Creating an account on Reddit

Creating an account on Reddit in 2020 is as necessary as creating one today. The website has over 430 million monthly active users and is an excellent place to increase brand awareness. Before you get started, you need to know the platform’s rules. Reddit recommends that you join no more than five communities and keep your preferences simple. In this order, you’ll be able to stay within your niche while still reaching a wider audience.

When creating an account on Reddit, you’ll have to confirm your email address. This way, you’ll have access to your account and profile, and you’ll be able to view and respond to comments on your posts. Once you’ve set up your account, you’ll want to subscribe to several default subreddits, or you can start your own. Your subscriptions are listed in your dashboard. Each and every comment you make will be linked to your user name and visible to anyone who sees it. You can also see deleted reddit posts and comments of users.