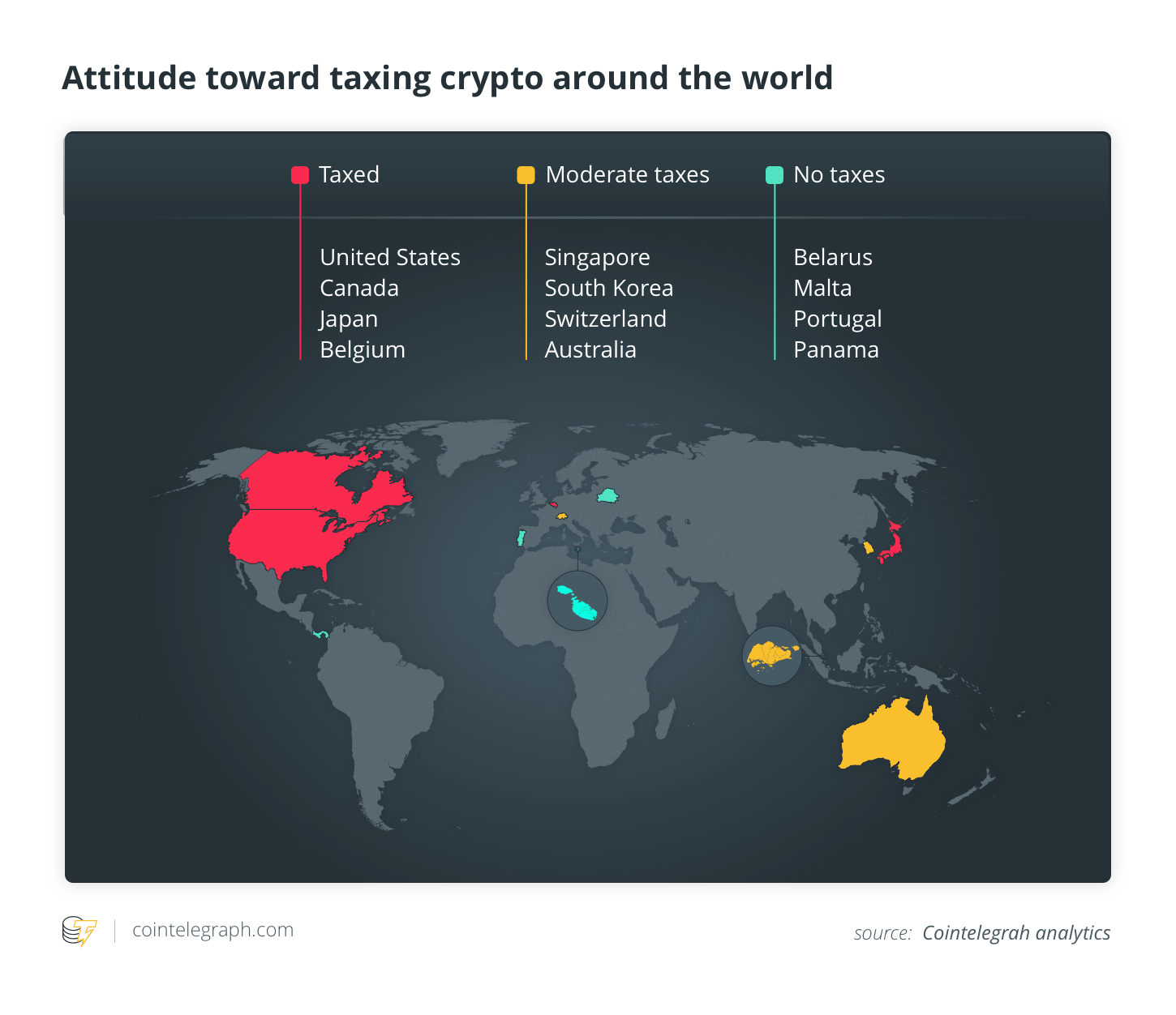

Countries where Bitcoin is taxable

Countries where Bitcoin is taxable

Tax is not constant, which means it varies, bypassing the time. The government replaces the old taxation policies and regulations with new taxable rules and policies over time. So here, we cannot say tax regulations are constant. In some countries, taxation policies change regularly. In some countries, it takes time, so according to the change, all the data may be different after a certain period. We cannot provide you with the latest data, and after some period, the taxation rule will be change, so you must know the taxation policies. It is the data at the time of writing this article.

There is no government in the European countries, and the European unions issue all the taxation policies and regulations. There is no certainty of taxation guides because it depends upon the decision of the European associations. Still, in other countries, the government can issue the taxation policies or guideline in a given period after passing the law of that guideline.

The following is the list of taxable countries at the time of writing this article, and after some periods, government rules and regulations will change. You have to up to date by reading the latest news about the laws and regulations of your country to know whether bitcoin is still taxable or not.

1. Brazil

The tax authority issued the taxation guideline by considering the bitcoin as a digital asset, and according to the taxation guideline, people that use bitcoin as a payment method will be under the capital gain of 15%, which will be charged at the time of sale of any asset by using the bitcoin as a payment method.

2. Australia

All the transactions that will make with the bitcoin payment method will be charged as GST (Goods and Services tax). In simple words, if any person will purchase goods or services via paying bitcoin, he will have to pay GST including in it.

3. Bulgaria

Bulgaria is a European country that is taxable, and in this country, bitcoin is taxable. According to the taxation law or guideline of this European country, any sale or profit by selling goods and services and accepting payment via bitcoin payment method will be considered the income of that person and 10% capital gain will apply to each transaction amount that will make via bitcoin. If you earn money, then you can invest in bitcoin mining

4. Finland

The taxation of Finland is very confusing because, in 2014, the government of this country declared bitcoin as a commodity but bitcoin is a global currency. So it isn’t easy to understand, but it imposed capital gain on each transaction of bitcoin. The good idea is that you can check with the local government of Finland country.

5. Canada

Canada is also a country where bitcoin is taxable. In Canada, there are two methods for charging the tax. When you purchase goods and services from the merchant, merchants have to pay the income tax, and on the other hand, the second method is capital gain. So it is also confusing which is the right way to charge tax for the bitcoin platform.

6. Germany

In Germany, bitcoin is known as private money because bitcoin is a decentralized system, and there is no involvement of any third party like government, banks and other financial institutions. If you hold bitcoin for one year, which may be any amount, you are exempted from the tax according to the guidelines of Germany.

7. United States of America

With the unknown effect of bitcoin on America’s economy, it is difficult to find out the tax percentage that will be applied to the bitcoin. In this country, the government does not know how much they should charge and still figure out the tax percentage.

Conclusion

From the above information, we have learned that many countries are moving to make the digital currencies taxable because it is the source of income of the merchants by selling goods and services and accepting payment via bitcoin integration on their website. Different countries consider the bitcoin as other aspects, some countries called it a digital asset, assert, income source, and according to the consideration, the government apply taxation guidelines. If any merchant accepts bitcoin for selling their goods and services, bitcoin should be taxable because the merchant is receiving income.